Single Family Homes – Traditional Sales | Compared to November 2021

First-time buyers now represent 45% of all buyers, up from 37% of buyers surveyed last year, according to Zillow’s 2022 Consumer Housing Trends Report. If they can overcome affordability challenges, first-time buyers could be well positioned to continue increasing their share in today’s shifting market, with more options and time to decide on the right home.

The share of first-time buyers plummeted during the pandemic amid rapidly rising home values and tough competition, even with high demand coming from the large millennial generation. Zillow research found younger, likely first-time shoppers were losing out to older, repeat buyers who were able to tap the equity in their existing homes and use cash to make a stronger offer. A Zillow survey found younger buyers were more likely to report losing to an all-cash buyer at least once, as was the case for 45% of Gen Z and 38% of millennial buyers, compared to 30% of all buyers.

“First-time buyers now appear to be making relative gains as high mortgage interest rates disproportionately encourage current homeowners to stay put,” said Zillow population scientist Manny Garcia. “The flow of homes into the market is slowing, suggesting homeowners are likely comparing their current low mortgage rate to today’s rates and deciding not to move. While rising mortgage rates are hurting affordability for all buyers, first-time buyers may be less deterred by higher rates because they’re comparing a monthly mortgage payment to what they’re paying in rent.”

First-time buyers are making up a larger share of a smaller pie. Newly pending home sales were down 29% in August, compared to a year prior, as buyers struggle to keep up with higher home prices and interest rates. Home values remain 14.1% higher than last year, even after two consecutive month-over-month declines. When combined with rising mortgage interest rates, the typical monthly payment on a home is nearly 60% higher today than it was a year ago.

Recent Zillow research finds those affordability challenges have driven up demand for the lowest-priced homes in each market. While there are fewer buyers overall, first-time buyers may find more competition for starter homes.

The silver lining is that today’s much-needed market rebalancing has the potential to especially benefit first-time buyers, who have the flexibility to shop without trying to time the purchase of their new home with the sale of an existing home. Listings typically lingered 16 days on the market in August before going under contract, compared to eight days in June, meaning buyers have twice as much time to decide on a home compared to this time last year.

First-time buyers may also have more bargaining power as a growing number of sellers drop their prices. The share of listings with a price cut grew to roughly 28% in August, according to Zillow’s latest monthly market report.

As the market changes, aspiring first-time buyers may need to change their approach. These five tips are a good starting point:

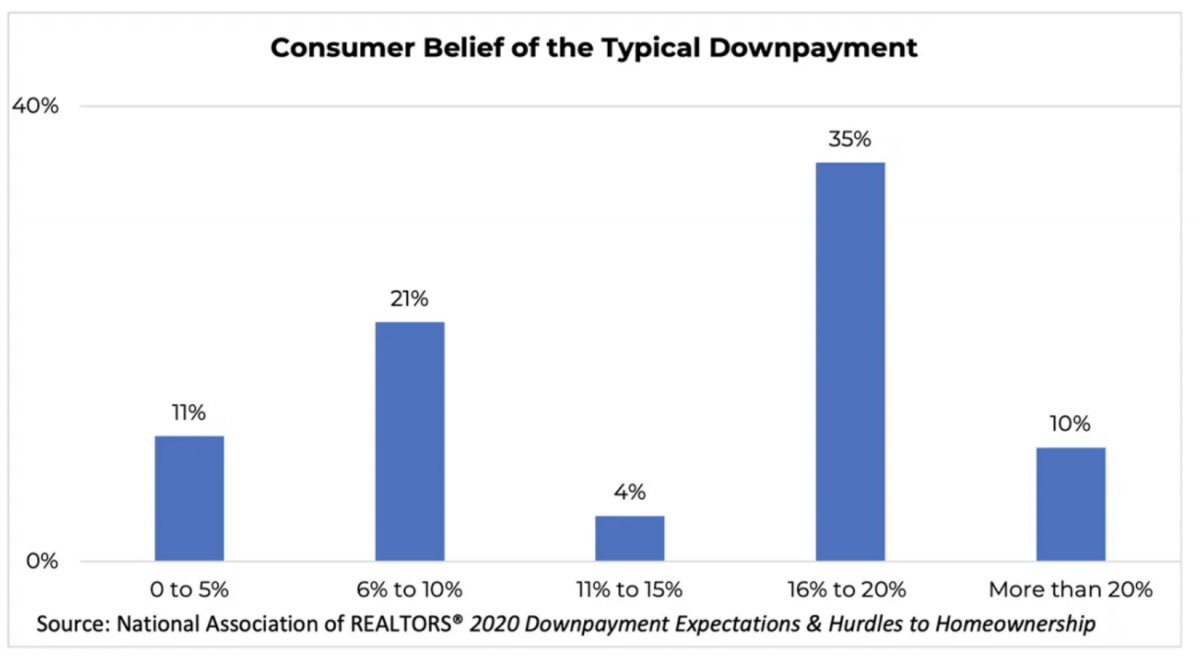

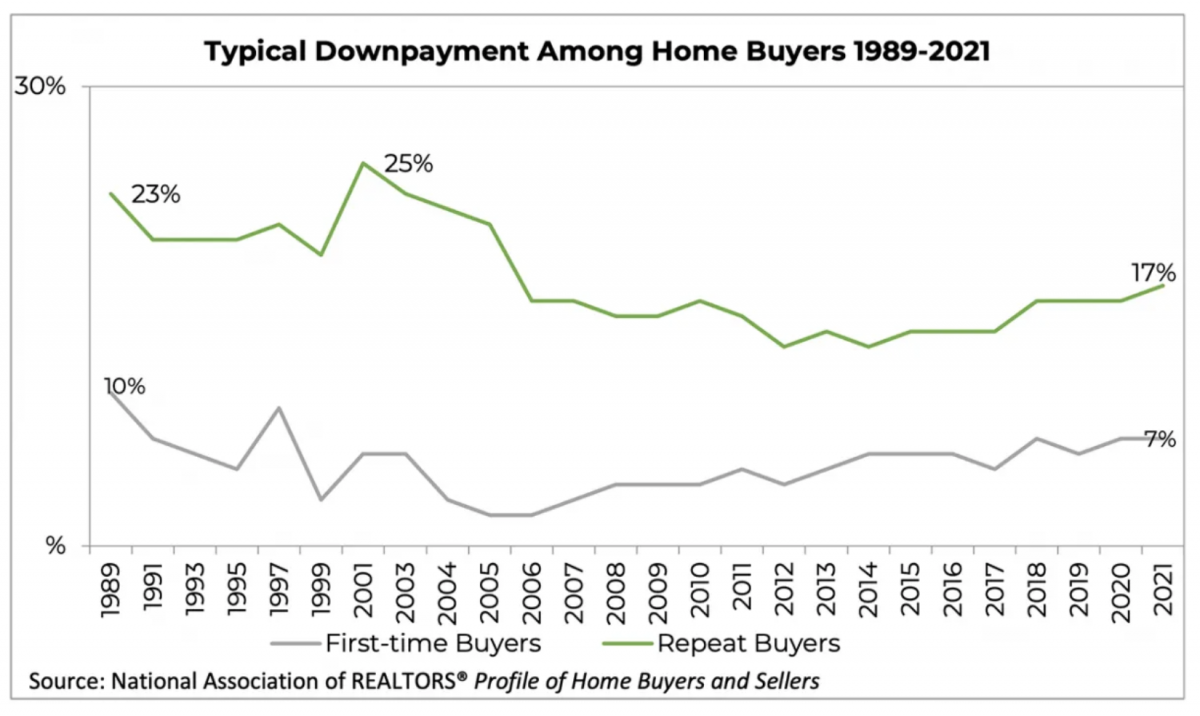

- Understand what’s affordable. As mortgage interest rates fluctuate, aspiring buyers can start with a mortgage calculator to understand what they can realistically afford on a monthly basis. Take into account some of the hidden costs of homeownership, such as property tax, insurance and HOA dues, which can add up to more than $750 per month. But it’s always best to leave some wiggle room in the budget for unexpected maintenance projects and emergency repairs. First-time shoppers should also explore down payment assistance programs they may qualify for.

- Finance first. First-time buyers can gain a competitive edge by getting pre-approved for a mortgage. A Zillow survey finds 86% of sellers prefer a buyer who has been pre-approved, as opposed to pre-qualified, for a mortgage. This financial check gives sellers more certainty that a buyer will close on time, and it allows buyers to make a stronger, faster offer the minute the right home hits the market. Buyers can start the pre-approval process online. Don’t hesitate to try, try, try again. Nearly half of all first-time buyers (47%) are denied a mortgage at least once before ultimately getting approved.

- Hire the right agent. An experienced agent will have a finger on the pulse of their local market and know all the changes happening in it, and they can help buyers make strategic decisions to win. They’ll know when to come in with an offer under list price or when to expect a bidding war. Buyers should plan on interviewing their top candidates and asking the right questions.

- Shop smarter with tech. New real estate technology can help first-time buyers make faster, smarter decisions. Virtual 3D Home tours and interactive floor plans give shoppers a more authentic experience of a home, allowing them to quickly narrow down their options and tour fewer homes in person.

- Keep the contingencies. With less competition, first-time buyers should have the leverage to include important contingencies in their offers that could potentially save them a lot of money in the long run. An inspection contingency can identify major structural, mechanical or safety issues that could be extremely costly to repair and cause buyer’s remorse. A financing or appraisal contingency will ensure a buyer can walk away with their earnest money if a home fails to be appraised for the offer price or if their financing falls through.

Copyright © 2022 BridgeTower Media and © 2022, The Mecklenburg Times (Charlotte, NC). All rights reserved.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link